As you might have already read on the internet or on the news, the Ministry of Social Security in Spain has approved in Parliament a new scheme for Autonomos. These are self-employed people who work here and many ex-pats fit this category.

From 1st January 2023, the new rules begin. Effectively, if you are self-employed in Spain you will pay your monthly Autonomo based on your income. The more you earn, the more you pay. So far so good.

How does it work?

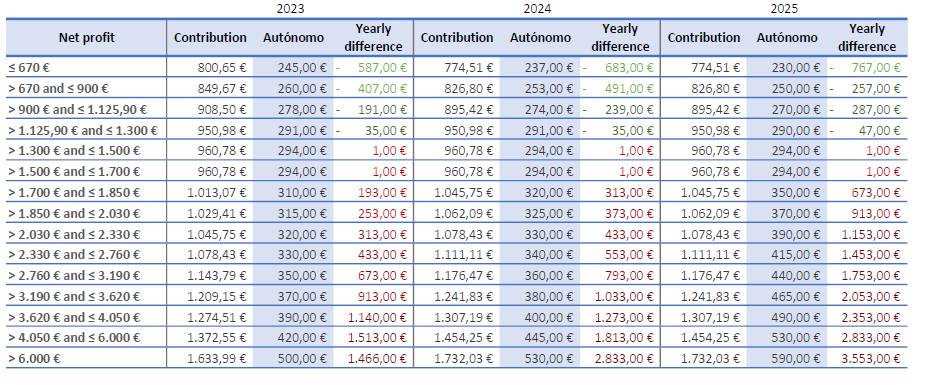

At the beginning of each year, you have to inform Social Security of a forecast or estimate of your expected profit for that year. This figure tells you the amount of autonomo tax you have to pay based on the table attached.

You will have 6 opportunities a year to revise the autonomy. This is just in case you are paying more than you have to or if you want to pay more. You will pay more only if your profits are higher than expected.

When the year is finished, then we have to calculate the final figure for the year in order to in which threshold you are. You have three possible scenarios:

- You paid more than you had to. Social Security has 4 months to pay you back the difference.

- You paid less than you had to. You have to pay Social Security in 2 months.

- You paid exactly what you had to. Nothing to do.

Which is my threshold as a self-employed worker in Spain?

Let’s use the following example for 2022:

- Income: 22.000 €

- Expenses: -2.000 €

- Social Security: -3.500 €

Your taxable profit in this example is 16.500 €. For this calculation, we don’t include Social Security as an expense, so your profit is, as far as the Spanish tax agency is concerned, 20.000 €. Now you can deduct 7% of that figure (3% if you autonomo societario), so the result is 18.600 €. You divide that by 12 months and the result is 1.550 €. We check that threshold on the table and you will pay 294 € in 2023.

We hope that makes sense. Our expert in Spanish tax, Rafa Hernandez is available to clients of Spanish solutions to help make this clear.

What will happen in 2023?

You will carry on paying the same figure as in 2022 but you have between January and 31st October 2023 to inform your expected income in 2023. Once you have confirmed it, you will start paying based on this new scheme.

Social Security will check with Tax Agency in September 2024 the income you submitted in your tax return and before 30th April 2025 they will adjust to the correct figure to be paid without late interest nor fines.

Due to the fact this new scheme is a bit tricky, we advise to update your autónomo as soon as possible to avoid a huge bill to be paid in 2024.

enquiries@spanishsolutions.net

2 Comments

Frazer

Perhaps change it to “We check that threshold on the table and you will pay 294 € *per month* in 2023” to make it clear.